- This website supports IPv6 access

- 中文

- Contact Us

CFETS-NEX CNY Money Market Sentiment Indicator is an innovative sentiment index generated by CFETS-NEX to objectively measure the interbank money market liquidity. Based on the real-time quotes in the interbank money market, CFETS-NEX professional research team eliminates fake or redundant quotes, collects data of all variables affecting the liquidity of transactions, uses the model of Time Series Global Principal Component Analysis (GPCA) as well as varying coefficient model, applies dynamic weighing, considers the sentiment damping factor, uses Bootstrap re-sampling and methods such as Monte Carlo to simulate the market structural distribution, and eventually constructs this prudent index. CNY MMSI, with a simple but clear form, is an objective and neutral indicator which directly displays the liquidity of money market. Its strong comparability and continuity allow users to interpret and make further analysis. Moreover, the institutional indicator fulfills diverse needs of different types of institutions for this index.

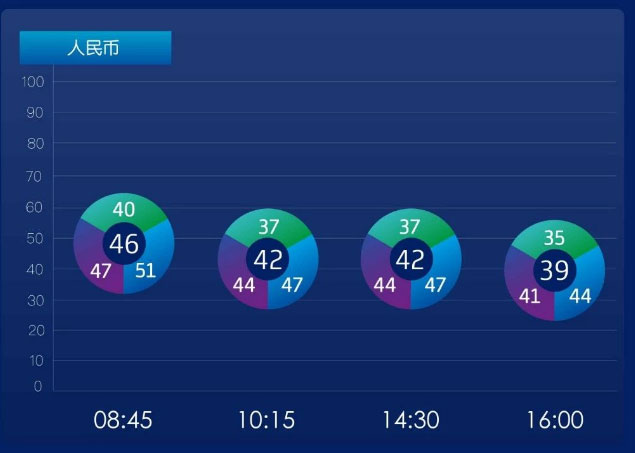

The indicator ranges from 0 (money extremely loose) to 100 (money extremely tight), with a reading of 50 representing an equilibrium state.

The indicator is divided into the general and the institutional one. The former reflects the whole picture of the market and the institutional shows three different types of institutions—— large banks, small & medium banks and other non-traditional financial institutions

CNY MMSI is currently generated daily at four points in time (08:45、10:15、14:30、16:00) .

Display Discription:

center - the whole market;

green - large banks;

purple - small & medium banks;

blue - non-traditonal financial institutions

Display Discription:

center - the whole market;

green - large banks;

purple - small & medium banks;

blue - non-traditonal financial institutions

CFETS&CFETS-NEX USD Interbank Deposit Market Sentiment Indicator is an innovative sentiment index jointly created by CFETS and CFETS-NEX to objectively measure the money market liquidity in the onshore USD interbank deposit market. The index ranges from 0 (money extremely loose) to 100 (money extremely tight), with a reading of 50 representing an equilibrium state. This indicator is currently announced daily at 9 AM.

Based on the real-time quotes in the USD interbank deposit (onshore) market, the professional research team eliminates fake or redundant quotes, considers factors such as the number of participating institutions and the volumes of different terms, applies dynamic weighing, and uses the principle of homogeneous structure to construct this index. Meanwhile, the percentage of unfilled orders due to limited quota is considered as the correction term of this indicator.

USD IDMSI, with a simple but clear form, is an objective and neutral indicator which directly displays the money liquidity in the USD deposit (onshore) market. Its strong comparability and continuity allow users to interpret and make further analysis, and also benefit traders to make capital pricing and transactions.

CFETS-NEX Indicators which source from the market data display the condition of the market. They are not advice on trading and investment and should not be treated as such. CFETS-NEX is not responsible for the accuracy. No part of indicators may be copied, published, issued or quoted by any means without written permission from CFETS-NEX. CFETS-NEX reserves the right to pursue any infringement.